Progress 0%

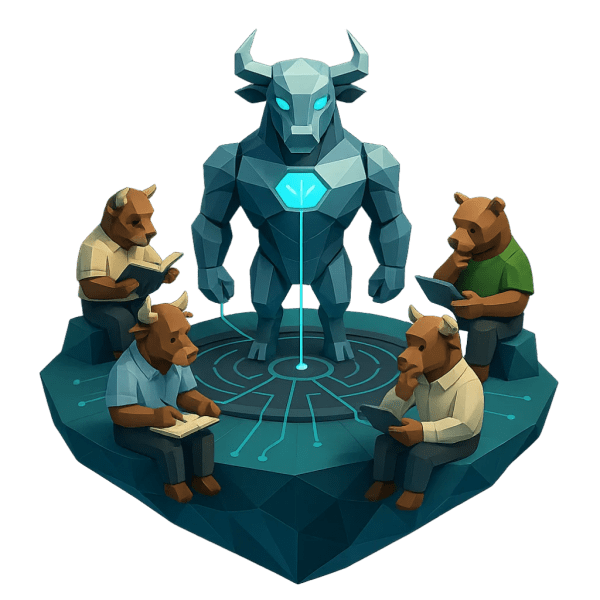

Build a mindset for long-term investing

Learn how emotions affect decisions, strengthen your thinking, and unlock rewards as you complete the island.

Overconfidence & regret

1 of 10 topics

The high score trap: when ego kills your strategy.

Overconfidence and regret are classic boss fights in your brain. One tells you you’re a genius. The other whispers you messed everything up.

This skill reveals how these emotions distort your decisions, especially after big wins or painful losses. You’ll learn how to build humility into your strategy and stop letting pride or shame run your trades.

You'll learn:

- Why overconfidence after gains leads to risky bets, tunnel vision and a false sense of control

- How regret after losses makes you freeze, revenge trade or abandon your long-term investing plan

- How to spot ego-driven impulses early and build safeguards to keep your decisions grounded and smart