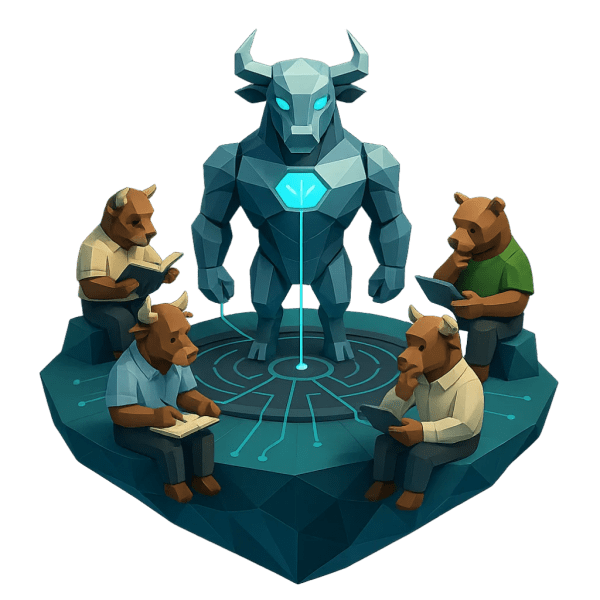

Learn how AI tools are changing investing

Explore tools, risks, and strategies while earning rewards as you progress through the island.

Understanding the promise and limits of AI in investing

How prompts, data, and bias shape AI-driven investment outputs

AI is changing how investing works. From stock screeners and robo-advisors to chatbots that generate strategies in seconds, it feels like machines suddenly have the upper hand. But AI isn’t magic. It doesn’t think, predict the future, or understand markets the way humans do. It processes data, follows patterns, and reflects the assumptions built into it.

This island is about understanding what AI actually does in an investing context. You learn how algorithms analyze data, where their strengths come from, and why their outputs are only as good as the inputs you give them. Used well, AI can save time, surface insights, and support better decisions. Used blindly, it can amplify errors, hide risk, and create a false sense of certainty.

You’ll explore how to work with AI instead of outsourcing your thinking to it. That means asking better questions, spotting weak or misleading tools, understanding where automation helps and where it breaks down. The focus isn’t on beating the market with prompts, but on becoming a smarter investor in a world where AI is everywhere.

This island helps you stay in control while others chase shortcuts.

You’ll learn:

- How AI tools work in investing and what they need to produce useful results

- How to spot good AI tools, weak signals, and common failure points

- How to combine AI-driven insights with human judgment and long-term thinking

Building on News and Hype Cycles, this island explores how AI filters data and narratives before the Strategy Codex brings everything into a structured approach.